Renters Insurance in and around Joplin

Welcome, home & apartment renters of Joplin!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Joplin

- Webb City

- Carl Junction

- Carthage

- Seneca

- Bentonville

- Fayetteville

- Rogers

- Fort Smith

- Neosho

- Nevada

- Springfield

- Kansas City

- Wichita

- Kansas

- Tulsa

- Miami

- Wyandotte

- Pittsburg

- Grove

- Missouri

- Arkansas

- Oklahoma

Calling All Joplin Renters!

No matter what you're considering as you rent a home - utilities, number of bedrooms, size, condo or apartment - getting the right insurance can be important in the event of the unexpected.

Welcome, home & apartment renters of Joplin!

Rent wisely with insurance from State Farm

Why Renters In Joplin Choose State Farm

When the unpredicted break-in happens to your rented apartment or townhome, usually it affects your personal belongings, such as a tablet, a laptop or a microwave. That's where your renters insurance comes in. State Farm agent Andrew Parker has a true desire to help you evaluate your risks so that you can protect your belongings.

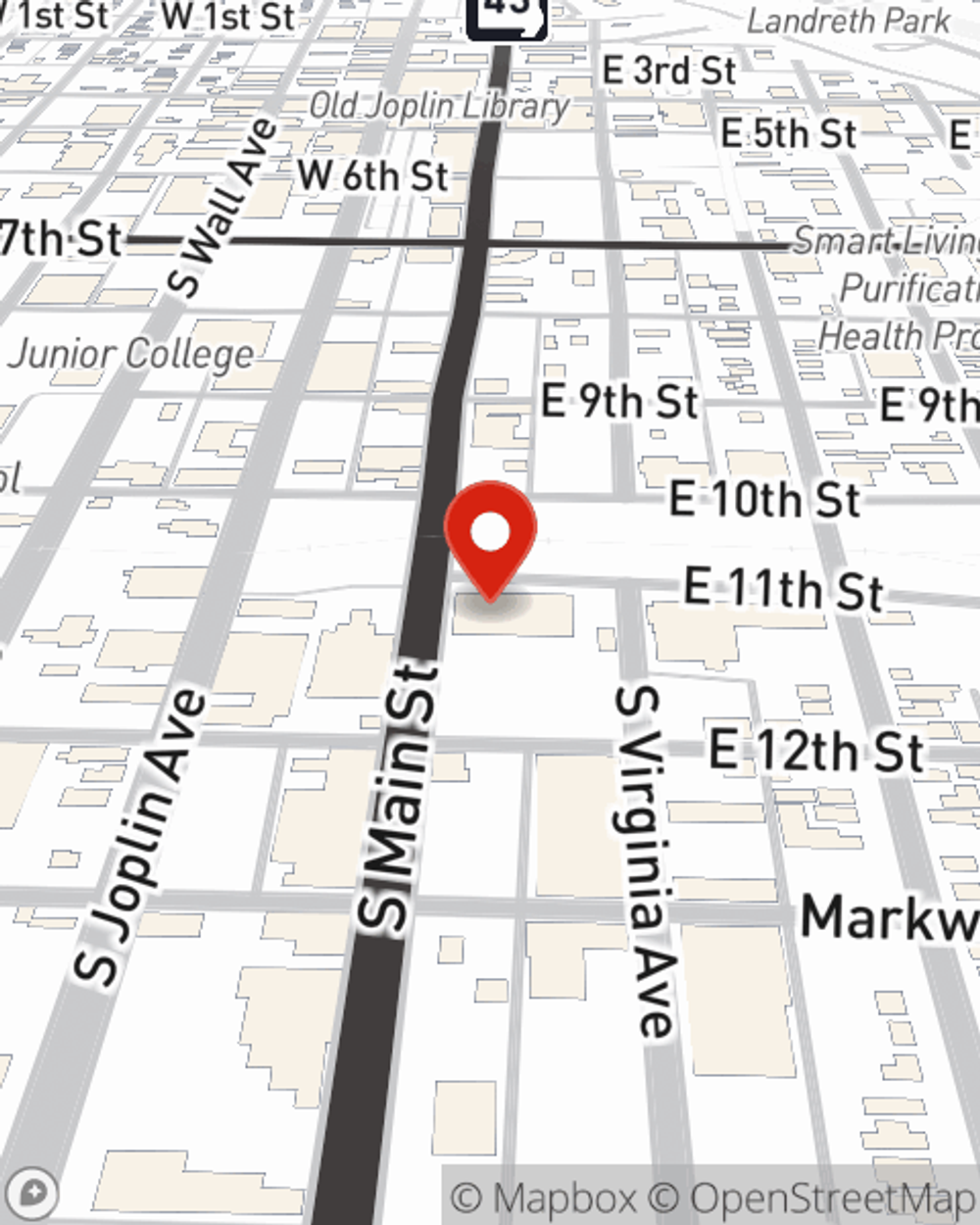

Renters of Joplin, State Farm is here for all your insurance needs. Get in touch with agent Andrew Parker's office to learn more about choosing the right policy for your rented property.

Have More Questions About Renters Insurance?

Call Andrew at (417) 781-2245 or visit our FAQ page.

Simple Insights®

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Andrew Parker

State Farm® Insurance AgentSimple Insights®

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.